Banpu Public Company Limited reported a net loss of $42.76 million for the first half of 2025, as significant non-cash foreign exchange losses masked a period of strong operational performance and strategic growth, particularly in its United States natural gas portfolio.

The Thai energy conglomerate generated total sales revenue of $2.52 billion and an EBITDA of $571 million. The company attributed the bottom-line loss to the appreciation of the Thai Baht against the U.S. Dollar, emphasizing that the accounting charge did not impact its cash position or operational health.

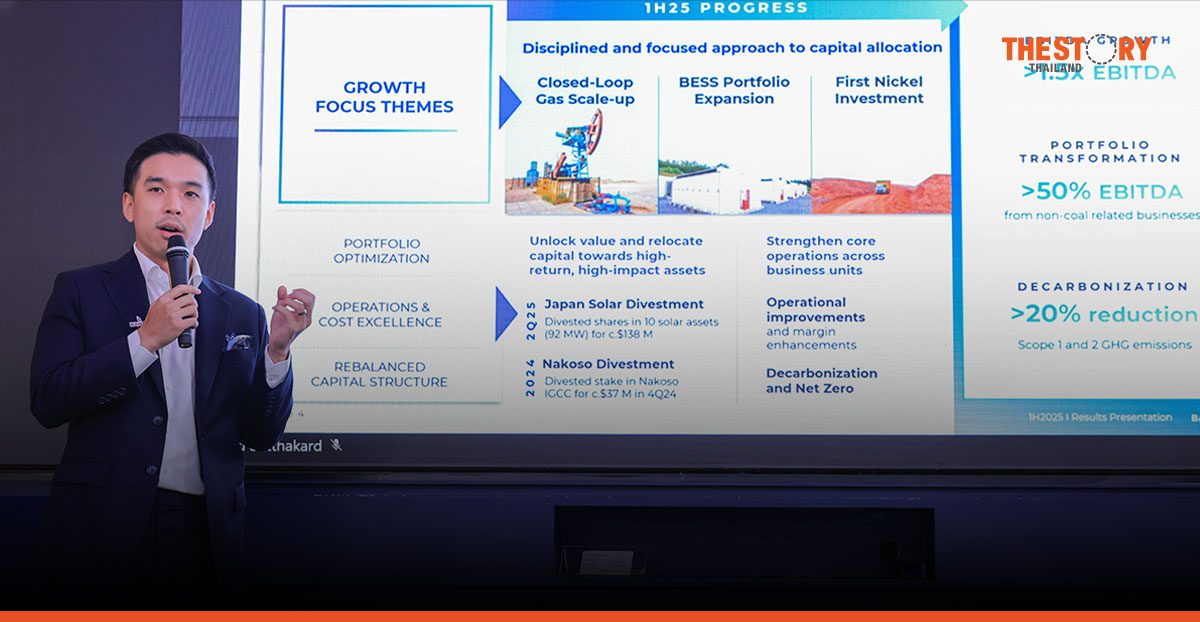

The results reflect the company’s ongoing strategy to navigate volatile energy markets by reallocating capital into higher-growth sectors. “In the first half of this year, Banpu has advanced growth by focusing on portfolio optimization, relocating capital towards high-return, high-impact assets,” said Chief Executive Officer Sinon Vongkusolkit.

A key bright spot was the expansion of its U.S. gas business, BKV Corporation. BKV moved to acquire Bedrock Production, LLC, adding substantial natural gas and midstream assets in the Barnett Shale of Texas.

Once finalized in October 2025, the deal is set to boost BKV’s production by 108 million cubic feet equivalent per day (MMcfe/d) and increase its proven reserves by approximately 1 trillion cubic feet equivalent (Tcfe).

The division was further bolstered by a favorable market, with Banpu’s average gas selling price climbing to $2.92 per MMBtu from $1.82 in the first half of 2024.

In contrast, the legacy mining business faced significant headwinds from lower global coal prices, which weighed on the division’s financial performance despite a marginal increase in sales volume and effective cost-control measures.

Signaling a strategic pivot, Banpu also made its first foray into nickel mining with an investment in Indonesia’s PT Adhi Kartiko Pratama Tbk (AKP), aimed at capturing growth in the clean energy and electric vehicle supply chains.

Momentum also continued in the company’s push into greener energy. Its renewables portfolio grew to 969 MW of capacity. The energy storage business was a focus of investment, with a new 58 MWh facility in Japan commencing operations and a major 1,400 MWh project in Australia, the Wooreen Energy Storage System, expected to be operational by 2027.

AI and Data Reshape Lending in Thailand

The Autonomous AI Era: A New Playbook for Business